6:16

If it’s not the winter chill sending shivers down your spine, then it might be the prospect of an economic recession in the coming months.

While the reasons for this downturn are multi-faceted, it’s important to prepare for what’s to come and what will emerge.

Onshape co-founder and former SOLIDWORKS CEO John McEleney is here to give some advice and share insights on how to prepare for – and survive – an economic slowdown.

How Should Product Development Companies Prepare for an Economic Slowdown?

As storm clouds gather over the global economy, there's no question you have to prepare yourself and your company to survive – but it’s equally important to find a way to thrive. People often fail to realize that challenges like these can also present new opportunities.

After fully understanding your financial reality by cutting where you need and saving what you can, it’s time to hunker down to weather the storm.

But don’t stay still. Now is the time to stand up, stretch, reach to the skies and think about the key areas of your product development business that you want to retool.

Of course, the core product or service should be considered, but it’s also important to look at other areas of the business, for example: customer support, marketing, sales, etc.

I encourage you to think beyond 2-3 years and ask yourself:

- What will our company look like? How will the market evolve?

- Will we have new competitors?

- Will the existing ones be stronger or weaker?

- If you have one gold shekel, where do you want to invest it?

- What will have changed during the downturn?

- How are you going to be able to better serve your customers? With a better product? Better support? Or by improving your go-to-market execution?

So Businesses Should Spend Money to Prepare?

Perhaps I can rephrase the question: “Should the business spend money to prepare?” or “Should they prepare to spend money?” I think the answer is: YES.

Typically, the immediate reaction for most people when facing a slowdown is to cut expenses. This is an appropriate and necessary action, however, it’s important to not take a “peanut butter approach.” Rather than making cuts across the board, look at areas where you can cut a little deeper to free up capital that can be deployed for your key strategic investments.

Simply put: While it’s good practice for leaders to cut areas of excess fat, it’s more important to cut in a way that continues to promote growth in the future.

You want to look at the other side of the downturn, in 18 months or two years out, and make decisions now that can put your business in a stronger position – not the same position.

If you think about it as an opportunity, then it puts you at an advantage because most people won't do that. It's counterintuitive to think strategically and aggressively when there's a downturn.

( unsplash.com / @cgbriggs19 )

Doesn’t Spending Money Seem Risky?

The challenge with most investments – whether it's technology, new process improvements, or training – is that people are resistant to change. Many simply want the status quo, which they believe will create stability.

Paradoxically, the way to have long-term stability is to make these investments to get a step ahead competitively when there's a downturn.

Most people are afraid to take the opportunity. This is when leaders need to demonstrate courage and conviction knowing that we will, in fact, exit the downturn and want to be in the best position to capitalize on the upturn.

How Have You Seen This Play Out in Real Life?

Yes. When the dot-com crash happened in 2001, many companies were going out of business or massively downsizing. It was a scary moment after years of go-go-go to a sudden collapse.

I was CEO at SOLIDWORKS at the time and we were growing well. But, like other technology companies, we were not immune to the overall economic environment and our growth started to slow. Naturally, we looked for areas where we could reduce expenses to weather the downturn.

At the same time, operationally we had this order management system and an order processing system that required too much manual interaction and it simply wasn’t scalable long-term.

As is usually the case, there were competing budget priorities and a new order management system wasn’t at the top of the investment list. When it came to tightening the budget, the new order administration moved further down the list.

Working with my leadership team, we sat down one evening with the order management group and each of us processed orders to get a firsthand look at the process and system. The following morning we had a budget meeting and reprioritized the key strategic areas to fund a new system.

The dot-com crash gave us the opportunity to invest in the infrastructure, the technology, the software, and the training to make the order management and fulfillment system far more efficient and scalable. While it was not the sexiest investment when the economy rebounded the new system could handle the growth of up to 10 times the revenue we had previously.

Where Should You Make Investments?

You shouldn’t make them everywhere but look for areas that will transform the culture, your operations, or processes.

For instance, in the software world, there’s this thing called tech debt. Every company has technical debt that builds over time. This is a particularly good area to focus on because, during normal times, your team might be so busy building new features and inevitably they keep adding to the technical debt pile and this may ultimately limit your ability to scale/grow your business.

It may be controversial in the priority list as there may not necessarily be any benefit to existing customers who are using the product today. But moving forward, it could be huge for all customers as you may have helped avoid bigger issues further in the future.

So, when there’s a downturn, it’s a good time to make those updates because you’re not fighting the fires of massive growth. You can control your expenses, make cuts where you need to, and create the resources and funding to pay down that technical debt and invest back into the core product.

( unsplash.com / @markkoenig )

What Should Take Priority?

As a business leader, you should look at areas that are high impact, low-cost in terms of time and dollars. What are the things you can do that will generate a greater return? Are there things you know you need to do to fix the “creaky machine”?

Make a list, you certainly will not be able to do all of them, but now you can prioritize which changes to make and how to fund them.

Are There Any Resources to Tap Into?

You should certainly have discussions with industry peers and get feedback from friends and colleagues.

There’s a blog post called “The Struggle” by Ben Horowitz at Andreessen Horowitz where he said, “When you got a problem, get as many heads on it as you can.”

I think that's the thing I would focus on.

Any Other Advice?

You’ve got to believe there's going to be a better day in the future. When it’s the darkest hour, it may be hard to sustain the faith that things will get better, but they will. And when it is better, what will you look back on and say, “Boy, I’m sure glad we made the investment when we did….”

Onshape Case Studies

Learn how forward-thinking companies are accelerating time-to-market, reducing overhead, and boosting innovation with cloud-native Onshape.

Latest Content

- Case Study

- Automotive & Transportation

Zero Crashes, Limitless Collaboration, One Connected Workflow With Cloud-Native Onshape

12.04.2025 learn more

- Blog

- Evaluating Onshape

Cloud-Native CAD 2025 Wins: Revenue Growth, Real-Time Collaboration, Unified CAD-CAM

12.17.2025 learn more

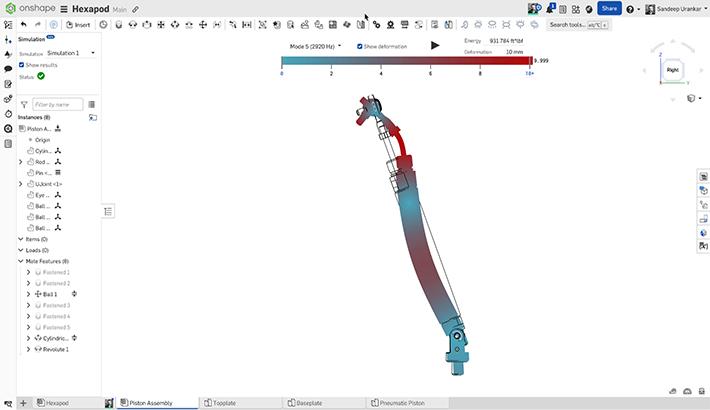

- Blog

- Becoming an Expert

- Assemblies

- Simulation

Mastering Kinematics: A Deeper Dive into Onshape Assemblies, Mates, and Simulation

12.11.2025 learn more

- Blog

- Evaluating Onshape

- Learning Center

AI in CAD: How Onshape Makes Intelligence Part of Your Daily Workflow

12.10.2025 learn more