07:52

The path from hardware prototype to successful company has never been more complex.

In a presentation hosted by PTC’s Onshape, four industry veterans shared invaluable insights about navigating this journey, drawing from decades of combined experience in venture capital, banking, law, and successful hardware exits.

John McEleney, a mechanical engineer turned entrepreneur, knows this path intimately. As the former CEO of SOLIDWORKS and co-founder of Onshape, he has experienced firsthand the evolution of a successful startup. Joining him was Ignacio Galiana, co-founder and CEO of Verve Motion, a rising star in the wearable robotics space that’s transforming industrial workplaces by making heavy lifting 40% lighter for warehouse workers.

The financial and legal expertise came from Yvonne McCague, managing director at J.P. Morgan’s Innovation Economy practice, and Patrick Connolly, co-chair of the emerging companies and venture capital practice at Foley Hoag. Together, they’ve helped deploy billions of dollars in startup funding and guided countless hardware companies from inception to exit.

However, “It's easy to start a company. It’s hard to build a business,” said McEleney.

This distinction becomes even more pronounced in the hardware startup space, where founders must navigate complex challenges from intellectual property (IP) protection to manufacturing partnerships.

Here are 15 critical first steps that successful hardware founders take – steps that many entrepreneurs overlook in their rush to market.

1. Secure Your IP Before You Quit Your Day Job

One of the most overlooked aspects of starting a hardware company is proper IP hygiene. Connolly emphasizes that founders must be meticulous about IP protection from day one. This means no using your current employer’s resources – not their networks, laptops, or even phone systems – when working on your startup.

The story of Verve Motion illustrates this principle perfectly. Galiana worked carefully with Harvard’s Office of Technology Development early in the process to reserve IP rights for his future company. This early attention to IP cleanliness later positioned the company for a successful fundraising sprint.

2. Structure Your Founding Team Thoughtfully

Avoid the common pitfall of splitting equity equally among co-founders. McCague notes that investors look closely at cap tables as signals of company maturity.

“It should be clear from the cap table who is the CEO, who is the clear founder and cofounders across the board,” she explains.

This means having tough conversations early about roles, responsibilities, and relative contributions.

Equitable Equity Distribution in Startups Navigating Co-Founder Departures

3. Implement Proper Vesting Schedules

While many founders skip this step, implementing four-to-five year vesting schedules for founder equity is crucial. This protects the company if a co-founder leaves early and signals to investors that the founding team is committed to the long haul. Consider reverse vesting structures, which can offer tax advantages when set up properly.

4. Build Your Advisory Board Strategically

Successful hardware founders typically build their advisory boards organically through meaningful interactions. Galiana shares that he met with dozens of potential advisors before finding five who became instrumental to Verve Motion’s success. These advisors later became angel investors and made crucial introductions to venture capitalists.

Networking and Advisory Boards Key Strategies for Founders

5. Validate Your Market Before Building

Hardware startups can’t afford the “build it and they will come” mentality. Before investing significant resources in prototypes, successful founders spend time understanding their target market. Galiana visited warehouses personally to understand worker challenges before developing Verve Motion’s solution. This hands-on market research proved invaluable in product development and fundraising.

6. Calculate Your True TAM

When presenting your total addressable market (TAM), avoid the classic mistake of claiming “just 1% of a trillion-dollar market.” Instead, focus on specific, addressable segments. Your TAM calculation should demonstrate deep market understanding rather than just impressive numbers. Consider import/export controls, IP protections, and realistic market access in different regions.

7. Plan Your Runway Carefully

Hardware companies typically need more runway than software startups. The current market expects 18-24 months of runway when raising capital. McCague emphasizes that starting fundraising discussions with less than a year of runway can make your round look like a bridge financing, which can deter investors.

Navigating Seed Rounds Trends and Insights

8. Choose Your Funding Vehicle Wisely

The funding landscape has evolved significantly. While convertible notes were once standard, Simple Agreements for Future Equity (SAFEs) have become increasingly popular for their simplicity and standardization. However, most investors now expect these instruments to include valuation caps to provide clarity on their potential ownership.

Understanding Seed Funding SAFEs Convertible Notes and More

9. Build Relationships with Strategic Partners Early

Hardware startups often benefit from strategic investors who bring more than just capital. However, as McEleney cautions, be careful not to “sell the company without selling the company.”

Structure strategic partnerships to maintain your freedom to exit through various paths.

10. Create a Detailed Product Development Timeline

Hardware development cycles are inherently longer than software iterations. Create a realistic timeline that accounts for prototyping, testing, certification, and manufacturing setup. This timeline should align with your fundraising strategy and runway calculations.

11. Consider Non-Dilutive Funding Sources

Before pursuing venture capital, explore non-dilutive funding options. These can include SBIR grants, accelerator programs, and strategic partnerships. J.P. Morgan’s McCague notes that there are over 260 accelerators nationwide, many offering non-dilutive capital to hardware startups.

Understanding the Lifecycle of Venture Capital Funds

12. Set Clear Milestones for Each Funding Stage

Successful hardware founders think in terms of concrete milestones rather than just time periods. When Verve Motion raised its seed round, Galiana planned for specific achievements that would position the company for Series A, including customer deployments and expansion orders.

13. Prepare for Due Diligence Early

Even at the seed stage, maintain organized documentation of your IP, contracts, and corporate governance. As Connolly explains, “You don't want to give [smart advisors, lawyers, and finance folk] any reason to pause on something and say, ‘Wait a second.’”

This becomes especially critical for hardware companies dealing with manufacturing agreements and supply chain partnerships.

14. Build a Strong Professional Network

The importance of building a professional network can’t be overstated. Utilize university entrepreneurship programs, attend industry events, and leverage your advisors’ networks. Many successful hardware founders, like Galiana, find their first customers and investors through these relationships.

15. Focus on Solving Real Problems

Perhaps the most fundamental step is ensuring you’re solving a significant problem. As McEleney emphasizes, too many founders focus on their solution before fully understanding the problem they’re addressing. Successful hardware companies typically emerge from deep understanding of industry challenges rather than just technical innovations.

Understanding Series a Funding Finding Product-Market Fit and Team Building

The Current Funding Environment in 2025

These steps become even more critical in today’s challenging funding environment. According to McCague, while fewer companies are raising capital (about 800 per quarter compared to 1,800 at the peak), those that do are raising larger rounds at higher valuations. The average seed round has increased from $1.9 million pre-pandemic to $3 million today, with pre-money valuations rising from $7 million to $12-$13 million.

For hardware founders starting their journey in 2024, this environment means excellence in execution is non-negotiable. Following these 15 steps won't guarantee success, but skipping them almost certainly guarantees failure. The panel emphasized repeatedly that building a hardware company is a marathon, not a sprint.

One often overlooked aspect of hardware startup success is choosing the right tools from day one – tools that can scale with your company’s growth.

This is where platforms like Onshape come in. As a cloud-native CAD and PDM system, it eliminates many traditional barriers hardware startups face: no expensive upfront licenses, no IT infrastructure to maintain, and built-in version control that prevents costly mistakes. The Onshape Startup Program has already helped hardware companies move from concept to production, making enterprise-grade design tools accessible to early-stage companies.

For hardware founders ready to take their first steps, the timing couldn’t be better. Despite the challenging funding environment, the opportunities for innovation in hardware have never been greater. Those who build thoughtfully, choosing the right foundation, tools, and partners, will be best positioned to turn their hardware vision into reality.

The Onshape Startup Program

Equip your team with full-featured CAD, built-in PDM, and real-time collaboration in one system.

Latest Content

- Case Study

- Aviation, Aerospace & Defense

Dufour Aerospace Accelerates Critical Cargo Drone Delivery with PTC’s Onshape and Arena

02.11.2026 learn more

- Blog

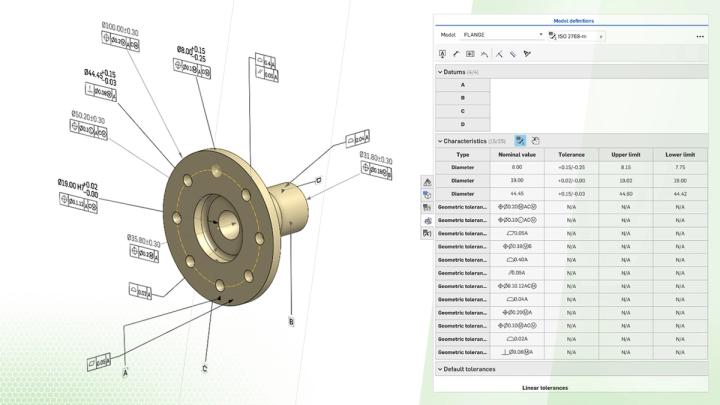

- Evaluating Onshape

- Collaboration

How Onshape Fixes the Broken Promise of Model-Based Definition

02.26.2026 learn more

- Blog

- Customers & Case Studies

- Automotive & Transportation

Powering Heavy-Duty Innovation: How Edison Motors Builds Next-Gen Hybrid Trucks with Onshape

02.26.2026 learn more

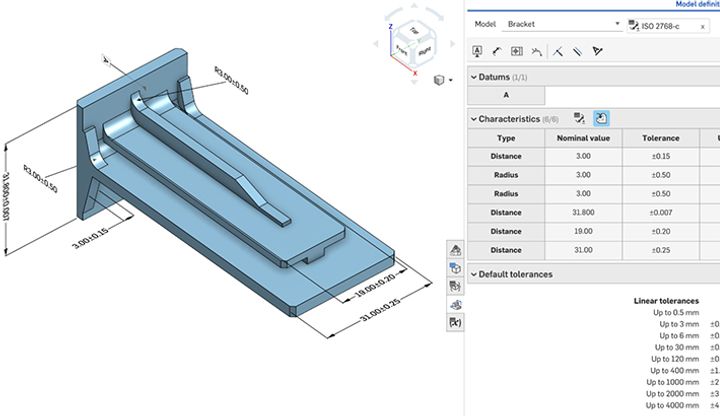

- Blog

- Evaluating Onshape

- Education

- Education & Universities

Future-Proof Engineering Education with Model-Based Definition in Onshape

02.24.2026 learn more